Chinese Ambassador brands BRI ‘debt trap’ accusation as false

Sri Lanka not a victim of China usury but by greedy Western private banks

CHINA’s ambassador to the Philippines, HE Huang Xilian, firmly rejected the allegation by Western governments and sections of the local mainstream media that its ‘Belt and Road Initiative’ (BRI) is a debt trap for its participants.

“Allegations that Belt and Road Initiative has created debt trap is false proposition,” said Amb. Huang.

“The BRI has always adhered to the principle of extensive consultation, joint contribution and shared benefits, bringing tangible benefits to the people of the countries concerned since it was launched nine years ago. In fact, none of the BRI partner countries endorses the so-called ‘debt trap,’ he pointed out.

“China always welcomes all initiatives to promote global infrastructure.

“The World Bank projections showed that if all transport projects under the BRI were implemented, they could account for 1.3 percent of global gross domestic product by 2030, of which 90 percent would go to partner countries and the larger chunk would benefit the low-income and lower-middle-income countries.

“During the period of 2015-2030, 7.6 million people will be lifted out of extreme poverty and 32 million people will be lifted out of moderate poverty,” he explained further.

Launched in 2013 by the Chinese government under President Xi Jinping, the BRI seeks to connect countries and regions all over the world who were once part of the famed ‘Silk Road,’ the main trading routes between the Chinese Empire starting from the Han Dynasty (202 BC -220 AD) and the rest of world, including the existing civilizations at the time in Europe and Asia such as the Parthian and Roman empires.

At its height, the Silk Road is the main artery of trade connecting China, Southeast and Central Asia, the Indian Subcontinent, the Middle East, Africa and Europe.

The Silk Road continued up to the 15th century AD when Constantinople (modern day Istanbul), capital of the Eastern Roman Empire, fell to the rising Ottoman Empire in 1453.

Unlike the West, which used commerce, religion and strong-arm diplomacy to dominate, and eventually conquer, other territories the way the Spanish, Portuguese and British Empires did, the BRI seeks to promote peaceful trade and economic development of all participating countries by improving their physical and maritime infrastructures.

“I believe what the international community wants to see is real money and projects that actually benefit the people among the BRI related countries, and this is just what the BRI will bring to them,” Amb. Huang added.

The bogey of the so-called ‘Chinese debt trap diplomacy,’ has become current once again with the collapse of the economy of Sri Lanka, which announced it is defaulting with its payment of its foreign debt. Sri Lanka announced it would be defaulting on its payment due for 2022 amounting to more than $7 billion as it only has around $1.6 billion in actual dollar reserve.

The ongoing modernization of the Port of Colombo, to the tune of more than $1.4 billion is mainly financed by loans from China. Historically, the port is a major sea route for the maritime side of the Silk Road.

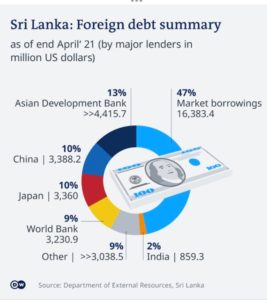

But actual numbers showed that the bulk of Sri Lanka’s debt, 47 percent, $16.383 billion of its outstanding foreign debt of more than $50 billion, were owed to Western private banks and the international capital markets (also private) thru the flotation of ‘international sovereign bonds (ISBs).

The data also showed that loans from China only constitutes 10 percent of Sri Lanka’s foreign debt, similar to those of Japan ($3.3 billion), while the World Bank (WB), accounts for about 9 percent ($3.23 billion) and the Asian Development Bank (ADB) 13 percent ($4.416 billion).

Sri Lanka’s huge reliance on Western private banks with its high interest rates to finance its economic development has now come to roost: This week, President Gotabaya Rajapaksa had to flee the country along with his family after rioters– who have been on the streets since April– stormed the Presidential Palace. Similarly, Prime Minister Ranil Wickremesinghe, was also forced to resign.